marin county property tax rate 2021

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Marin County California Property Taxes 2022

That is nearly double the.

. Our talented team will do everything possible to provide a great rental experience. Two Family - 2 Single Family Units. Total tax rate Property tax.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Marin county property management for quality tenants in quality homes. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Marin County Property Tax Search Mendocino County Property Tax Search Merced County Property Tax Search Monterey County Property Tax Search. The property tax rate in the county is 078.

And Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. A local agency within a specific tax rate area eg schools fire. Public Works Financing Authority Lease Revenue Bonds 2021 Series F Green Bonds.

Two Family - 2 Single Family Units. The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. Hamilton County collects on average 153 of a propertys assessed fair market value as property tax.

Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes.

Marin County Now Among The Highest In Property Taxes In The Country

Marin County Mails Property Tax Bills Seeking 1 26b

Attom Single Family Home Property Taxes Increased To 328 Billion In 2021 Mortgageorb

Transfer Tax In Marin County California Who Pays What

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Transfer Tax In Marin County California Who Pays What

Marin Wildfire Prevention Authority Measure C Myparceltax

San Francisco Bay Area Transfer Tax By City And County Updated For 2020 Torii Homes

Home Affordability Gets Tougher Across The U S As Prices And Mortgage Rates Surge

Marin Wildfire Prevention Authority Measure C Myparceltax

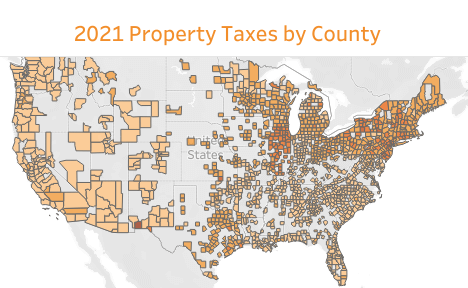

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Tax By County Property Tax Calculator Rethority

Los Angeles County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Calculator Smartasset

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

Marin Economic Forum Mef Blog Marin Economic Forum

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally